Simplifying IMPS Transfers for Effortless Banking

.svg)

Client

Bank of Baroda - It is second largest public sector bank in India

Collaborators

1 UX Researcher, 1 UX Designer, 1 Product Manager, 2 Senior UX Designer, 3+ Developers, and a Business Analyst, working closely with stakeholders from BOB

Project Type

Fintech

B2C Banking

Mobile Payments Native App

Transaction UX

Timeline

5 months

My Role

UI Execution & Iterations, Feedback Implementation, Cross-Functional Collaboration, Research Assistance, UX Audits, User Flow Creation, Interaction & Visual Design, Prototyping

Team

.avif)

The Goal

Improve IMPS transfers by simplifying the dashboard and fund transfer flow to reduce transaction drop-offs

IMPS (Immediate Payment Service) is India’s 24x7 real-time bank transfer system, allowing users to instantly send up to ₹2 lakh (approx. $2,400 USD) per transaction

Success Metrics

IMPS transaction drop-offs reduced by 50%, enabling 7.5 million users to complete transfers smoothly within just 3 months

Metrics were sourced from Bank of Baroda’s post-launch analytics; validated qualitatively through usability testing

The Challenge

50% of 10M+ active users failed to complete external fund transfers via IMPS

During the requirement gathering sessions, prioritizing the “Accounts” section out of the five key areas was a strategic business decision

.svg)

.svg)

Why Accounts?

.svg)

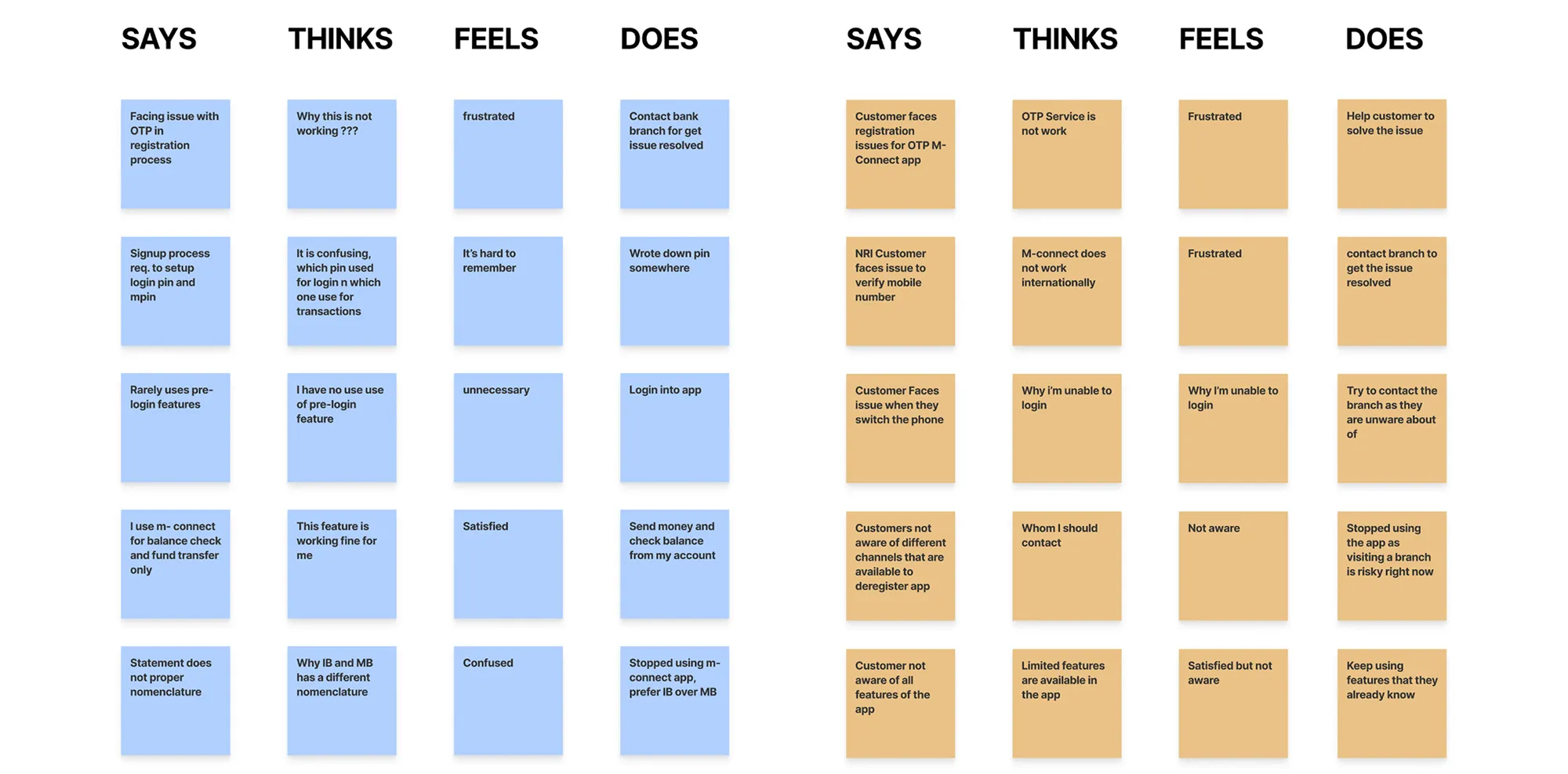

Validating Focus Areas With Customers & Staff

What We Learned from Stakeholders

Key features were missing

Account overviews were missing

Transfer methods confused users

IMPS issues drove in-person support

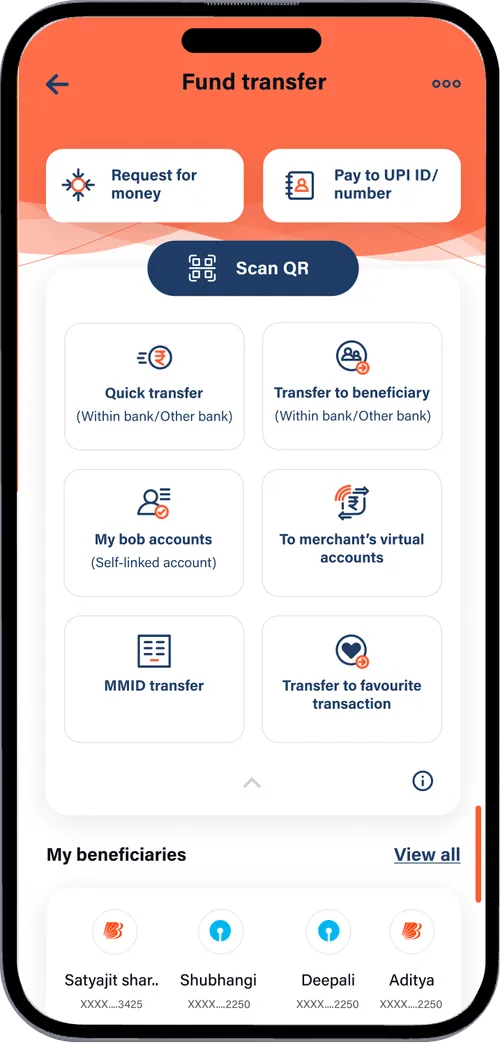

Auditing for Friction Points

Key actions were buried under irrelevant details

No clear guidance on transfer methods

Crucial info lacked structure and confirmation clarity

Iterations Shaped our Final Designs

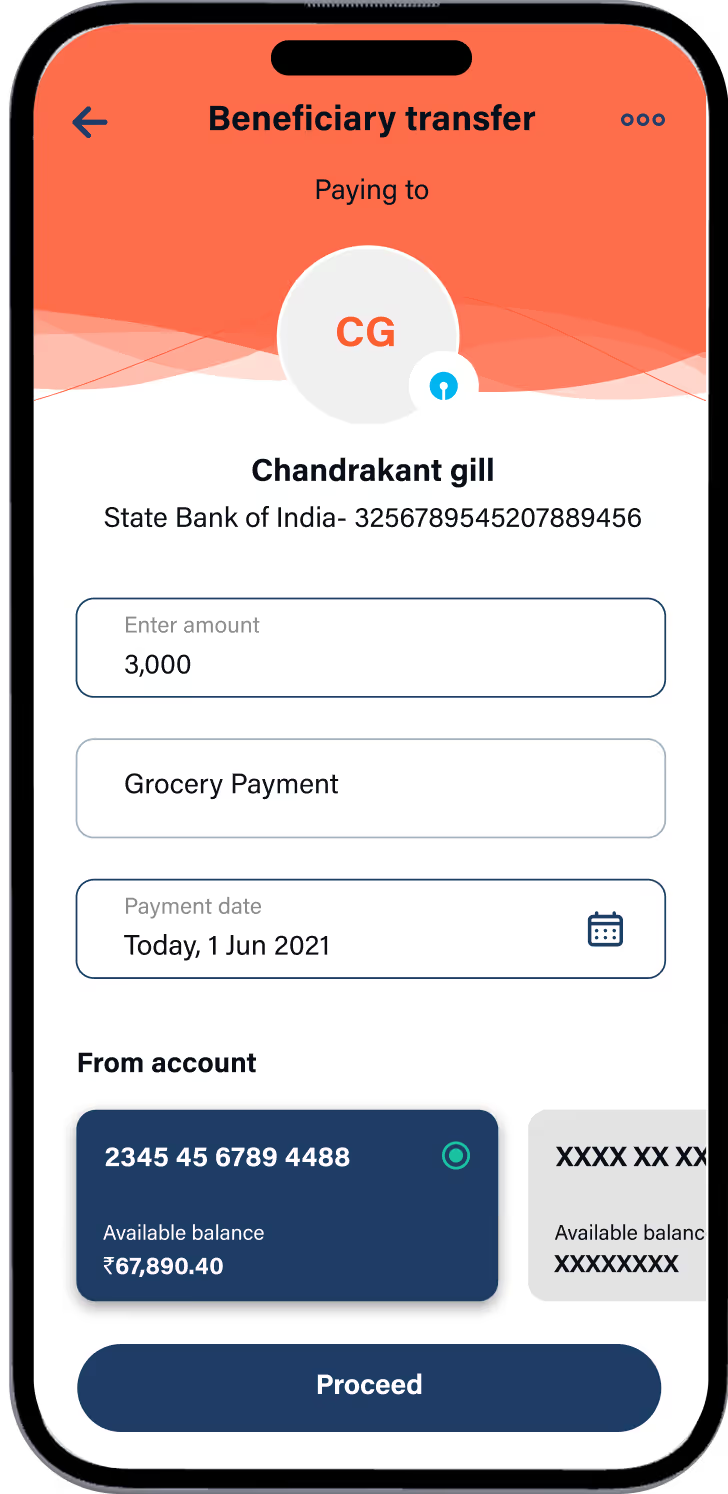

Final Designs

.avif)

Reflections

Ground level insights with stakeholders deepened my understanding of user pain points

Understanding business decisions behind design shaped my problem-solving approach

Every iteration taught me to stay curious, refine boldly, and uplight my visual craft